NFTs > Physical Art. Why digital art will completely disrupt physical art.

NFTs are a great way to enforce ownership of a piece of art. Arts are tokenized and their data is stored on a distributed ledger.

"How much money would Leonardo Da Vinci and Pablo Picasso make in this age of NFTs?" I asked a buddy over coffee.

Before he had a chance to respond, I said, "They'd certainly outsell both Cryptopunks and BAYC!".

To my astonishment, he patiently explained to me something I had never considered: "Bro, I guess they'd be meaningless in our current day because even finding the proper colors was rare at that time." Most of what was considered excellent then would now be regarded as mediocre.

Furthermore, "there are more colors and powerful tools today than ever before, and technology has been nothing but disruptive," he continued to say.

I was awestruck. His argument was controversial, but I thought it was a well-thought-out one.

In his response, he made me want to find the line between digital and physical art.

Now, I'd want to present my case.

Before and After the Blockchain Revolution

Unique and scarce assets were expensive to administer before Web3.0 because they relied on the validation and security of the centralized issuing entities, which were expensive to maintain.

In addition to cutting costs, the blockchain's decentralized and unchanging architecture makes it impossible to change.

A painting was stolen from a museum for the first time in history in August of 1911.

The iconic Mona Lisa was stolen from the Louvre during this heist.

On August 21, employee Vincenzo Peruggia, who was well-versed in the Louvre's security systems, was able to enter the museum unnoticed and remove the Mona Lisa from the wall without being observed.

What's so special about NFTs?

The blockchain network has never changed in its 13-year lifespan. It has defied all efforts to remove it.

If it had been an NFT, our own Vincenzo would never have gotten so close to the Mona Lisa.

Using NFTs is an excellent approach to ensure that a piece of art belongs to the owner. A distributed ledger has been used to store the data for the arts in tokens.

Everybody on the network agrees to keep a record of it. Participants in the network have access to information about the original owner, the preceding owner, and any intrinsic data that may exist.

To transfer ownership, all network participants must agree on the transaction at the same time.

Due to the nature of the blockchain, such an incident has never occurred in its 13-year history.

Every day, millions are transacted in the NFT industry, and billions will be in a matter of weeks.

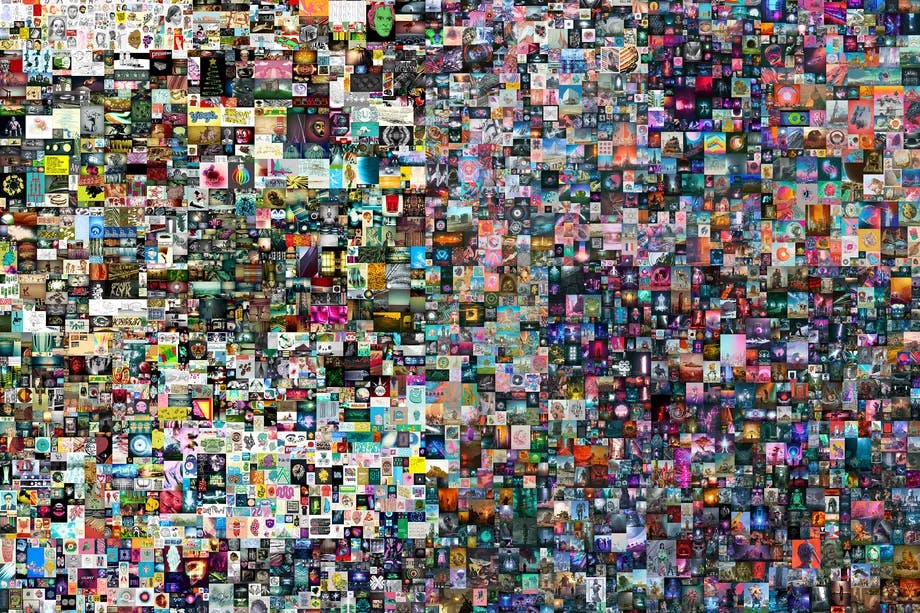

According to Guinness World Records (as of January 4th, 2022), Mike Winkelmann sold the most expensive NFT for $69 million to Vignesh Sundaresa, according to Guinness World Records.

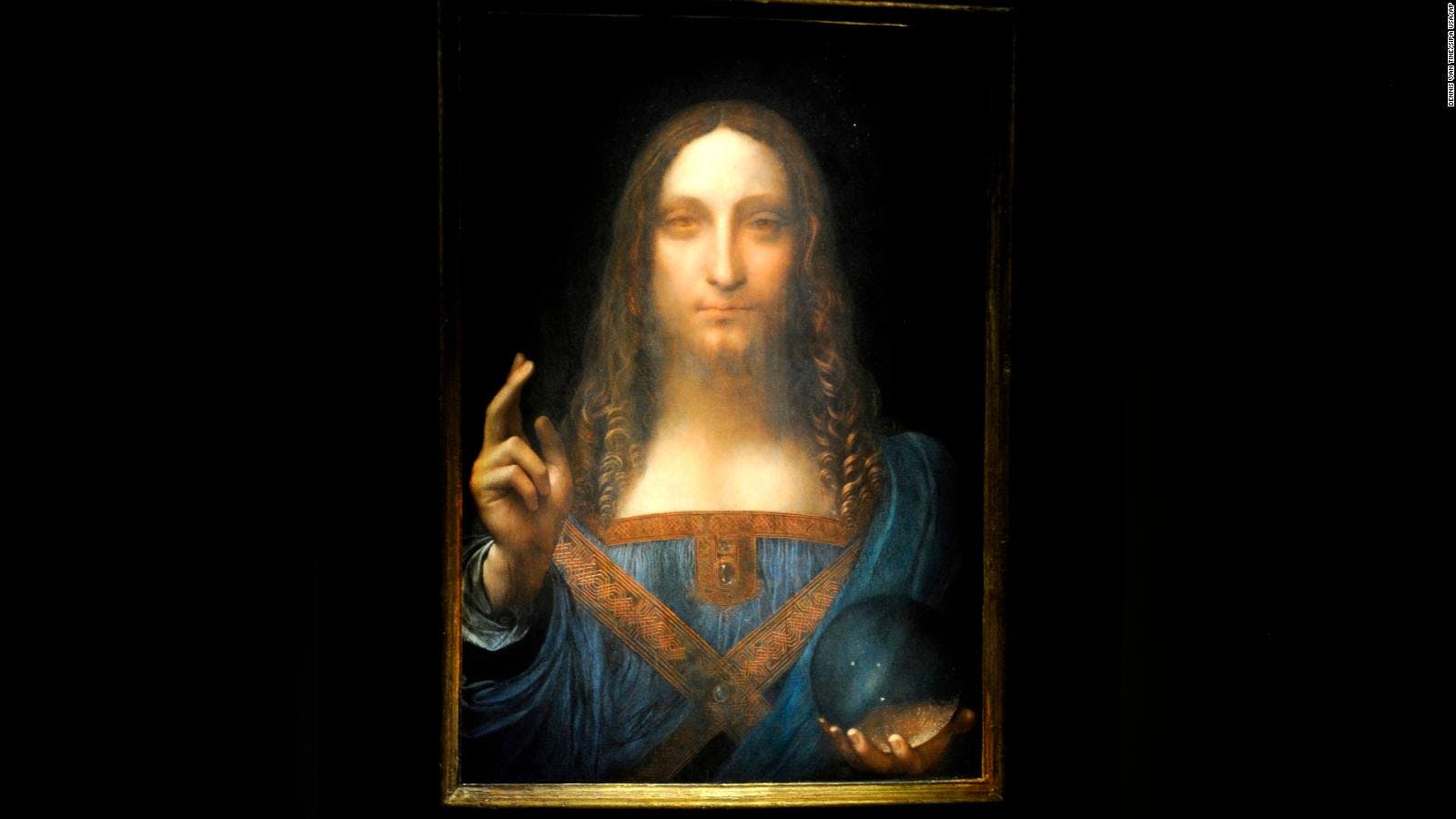

In contrast, the most expensive physical painting, which is [ Salvator Mundi](en.wikipedia.org/wiki/SalvatorMundi(Leonardo) by Leonardo da Vinci, sold for $450,312,500 (£343 million), as of this writing.

NFTs became popular a few years ago, with 2021 being the breakthrough year, although NFT trading volume exceeded $24 Billion in that year, despite the huge disparity between the two prices shown.

As proof of this claim, physical art dates back a million years.

The Blockchain-Based Digital Art Timeline

"Colored Coins" was one of the first efforts to try to add distinctive qualities to a token in 2013.

Before CryptoKitties came out on Ethereum in 2017, this allowed people to make their own Bitcoin assets, but the idea didn't catch on.

The ERC-721 token standard, which permits a token to hold more properties than can be found in a currency, helped NFTs break into the mainstream.

I've seen a lot of change in the last five years, and this concept seems to be the most disruptive of all.

Countless sums of money have been exchanged. There is a positive side to this technology in that it provides an equal chance for all artists to display and sell their work. It's impossible to say the same with real art, though.

It is not about "will" but rather "when" that the physical will survive.

The Future of NFTs

This type of ownership identification can be a good investment for collectors because it allows artists and producers to sell their work and make money every time it is sold to a new person. This means that they can make money again and again.

Royalties are the name given to these ongoing sources of income. Royalties can be included in the smart contract code and given out on the blockchain, too.

If the previous owner applied a 5% royalty to the artwork, they would receive 5% of the proceeds from each sale of the work.

As a bonus, because the NFT has information about its previous prices and owners, its credibility is not in question.

NFTs in the entertainment industry.

The entire impact of this tsunami has yet to be seen in the music industry, but I don't expect it to last long.

Artists no longer have the same level of collectibility that they did when CDs were still widely available. Spotify, Apple Music, and other streaming music services have changed that.

NFTs appear to offer a solution to this problem. How?

Fans can purchase an NFT for each album they purchase from an artist. A user would be able to stream the album it represents as many times as they wanted if they had this ownership.

It is because of this that people can get more media that they might not be able to get from the big music companies and subscription companies.

It is possible for NFT users to sell their albums in the event that they no longer enjoy a particular piece of music, giving the new owner all the express rights to do so.

Conclusion

The NFT and crypto ecosystem's trading volume and market capitalization grew like a snowball in the final quarter of 2021.

The future seems exciting.

Learn More

This blog is dedicated to educating curious individuals who want to learn about technology and improve their skills.

Check out the blog to show your support.